Table of Contents

About e Mudra loan

The e Mudra loan is a financial product offered by the Government of India that provides small loans to individuals and businesses for the purpose of financing their various entrepreneurial ventures. It is a part of the government’s broader goal to promote entrepreneurship and create jobs in the country.

The e-Mudra loan is administered by the Micro Units Development and Refinance Agency (MUDRA), a financial institution set up by the government to support the growth and development of micro and small enterprises in India. The loan is available to a wide range of individuals, including farmers, artisans, small business owners, and self-employed professionals.

One of the main advantages of the e-Mudra loan is its ease of access. The application process is completely online, making it convenient for applicants to apply from anywhere in the country. To apply for the loan, individuals must submit a simple online application form and provide proof of identity, address, and other required documents.

The loan is also very flexible, with no fixed end use. It can be used for a wide range of purposes, including purchasing equipment, purchasing raw materials, expanding a business, or starting a new business. The loan amount ranges from a minimum of INR 50,000 (about $700) to a maximum of INR 10 lakh (about $14,000).

Repayment of the loan is also flexible, with repayment terms ranging from 1 to 5 years. The interest rate on the loan is competitive, with rates starting at around 8% per year.

Overall, the e-Mudra loan is a useful financial tool for individuals and businesses in India looking to finance their entrepreneurial ventures. It is easy to apply for and offers flexible terms and competitive interest rates, making it a good option for those seeking small loans to start or grow their businesses.

SBI e Mudra Loan

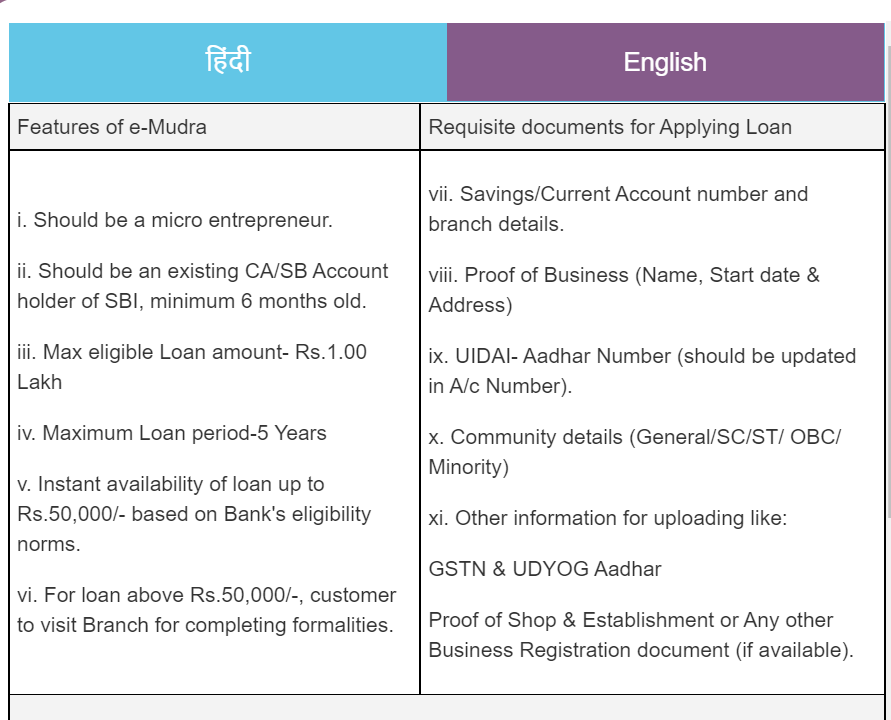

SBI Mudra Loan refers to the collateral-free business loans, MSME loans, and working capital loans offered to individuals, self-employed professionals, and Micro, Small & Medium Enterprises (MSMEs) under the guidance of the Micro-Units Development and Refinance Agency (MUDRA). Under the Mudra scheme, SBI offers business loans and MSME loans of amounts up to Rs. 10 lakh. SBI e Mudra loan can be applied for and availed online for amounts up to Rs. 1 lakh with repayment tenure of up to 5 years.

Source: https://www.paisabazaar.com/sbi-bank/mudra-loan/

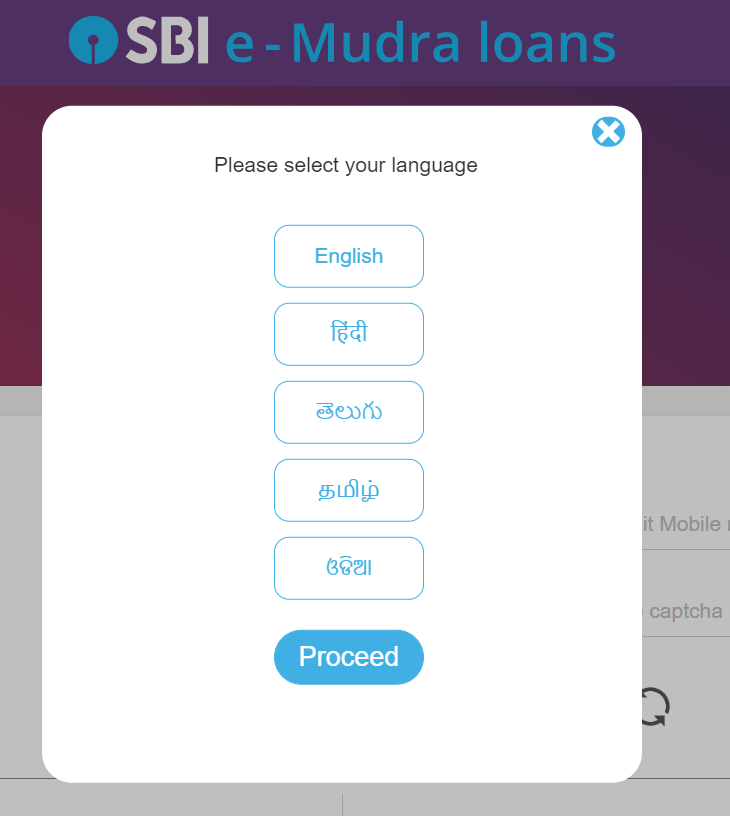

You can fill form in multiple languages

SBI Mudra Loans can be used to meet various working capital requirements, such as enhancing cash flow, purchasing raw materials, stocking up inventory, paying rent, for business expansion, and other business-related purposes. SBI Mudra loans and e Mudra loans are offered to individuals, MSMEs, businesses, and enterprises engaged only in the services, manufacturing, and trading sectors. Below mentioned are the features of the SBI Mudra Loan and SBI e Mudra Loan

Processing Fee & Charges:

Nil for Shishu and Kishor to MSE Units

For Tarun: 0.50% of the sanctioned loan amount + applicable taxes

Prepayment Charges

Between 3 years – 5 years (moratorium of up to 6 months) depending on the activity/income generation

Review of WC/TL to be done annually

Margin

Up to Rs. 50,000 Nil and From Rs. 50,001 to Rs. 10 lakh is 10%

FAQs

- Is SBI E-MUDRA loan available?

If you are having an Existing SBI saving or have a current account holding can now apply for the SBI Mudra loan online. Submit your Loan applications for up to Rs. 50,000 on the SBI e-Mudra portal – https://emudra.sbi.co.in:8044/emudra.

2. How can I get 50000 loan from SBI?

You can apply for e-MUDRA loan amount of up to Rs. 50,000 online at their official website or by clicking on the link: https://emudra.sbi.co.in:8044/emudra. The age of applicant should be between 18 and 60 years of age.

3. Who is eligible for e-MUDRA?

An Indian Citizen who has a business plan for a non-farm income generating activity such as manufacturing, processing, trading, travel, hospitality or service sector whose requires credit of up to 10 lakh can approach.

4. Can we get MUDRA loan online?

Yes. For higher amount, connect with Bank

5. When did e MUDRA loan start?

Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched by the Hon’ble Prime Minister on April 8, 2015 for providing loans up to 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY.

6. How long is e MUDRA loan sanctioned?

Once the application has been approved, the disbursal process is expected to take within 2 days after the acknowledgement. The expected turnaround time for MUDRA Loans is around 7-10 business days if documents are in order.

7. Is Mudra loan interest free?

No. Its a business loan. Interest rates on MUDRA loans start at the rate of 7.30% p.a. and the loan repayment tenure ranges between 1 year and 7 years. Please check with bank or at the link provided above for latest information as it gets changing